Pay a $3.23 premium per share ($323 for one contract of 100 shares $3,230 for 10 contracts). You decide to take out an iron condor with a 30-day expiration. Suppose you believe Microsoft shares, which were trading at $280, will not move much over the next 30 days. When one side or the other expires in the money, your losses can mount. You can find the delta of an option, along with other metrics, using a basic options calculator like this one on the Options Industry Council website.Īlthough it might sound a little counter-intuitive, an iron condor is most profitable when all four options expire out of the money. Delta also predicts the likelihood an options contract will end in the money. It's typical to have a $2 strike width between the long and short strike for most stocks."ĭelta (Δ) is a metric that predicts the change in the price of an options contract given a $1 change in the underlying security. Kaufman suggests caution: "Pick a call and put strike price that is one to two strikes further OTM. Finally, determine which strikes to purchase as a protection against a major move in the price.By following that rule, you will end up having a 60% to 70% probability of reaching maximum profit by expiration." If you were to select a call and put strike with a delta of 0.15 to 0.20 the call and put will have a 15% to 20% chance of expiring ITM. " Delta is a way of estimating the probability of the option expiring in-the-money (ITM) or profitable. "One approach is to consider the option's delta," says Kaufman. Then select which call and put options you will sell."That means choosing a date that is between 30 to 50 days to expiration." "While you can technically pick any amount of time to expiration, it's important to balance the time decay of the options with the ability to manage the trade," Kaufman advises. To create an iron condor, do the following: Recall that an iron condor is made up of four different options contracts that pair into two credit spreads, a bull put spread and a bear call spread. Note: Due to the combination of a high probability of success and low risk, iron condors are often employed as income strategies, not unlike fixed income investments. "Therefore, how you select these short strikes will dictate the credit received and the probability of reaching maximum gain." "An iron condor reaches its maximum gain if the stock price closes in between the call and put options sold," says Kaufman. While this strategy creates limited profit, it also limits risk. Profit is derived from the premiums collected from selling the two credit spreads of the iron condor. In part this is because the strategy is market neutral, meaning it doesn't matter whether the stock goes up or down in price. The biggest advantage of an iron condor strategy is its high probability of profit. Note: A put is an option to sell and a call is an option to buy. "The use of the word 'iron' comes from the fact this trade employs both calls and puts," notes Don Kaufman, co-founder and chief market strategist at the trading education firm TheoTrade. The long put and long call make up the wings. In the illustration above, the short put and the short call make up the body of the bird. A second, less common, type, the long iron condor, is not part of this discussion.Īn iron condor trade consists of two puts (one long and one short) and two calls (one long and one short), each with different strike prices but the same expiration dates. Note: The iron condor discussed here is technically known as a short iron condor. Read on to learn how iron condors work, when trading them can be profitable while limiting risk, when to use them, and why they are called iron condors in the first place. That means you can profit from them no matter which direction the underlying stock or index moves. Others, including one known as the iron condor, are non-directional, or market neutral. There are many advanced options trading strategies you can use based on how volatile you think a particular stock or index will be and whether it will rise or fall. If you predict correctly, you profit from the trade. Instead of buying the stocks, you use options to bet on the future direction and magnitude of the move in the price of the stocks. You might be familiar with the basic concept.

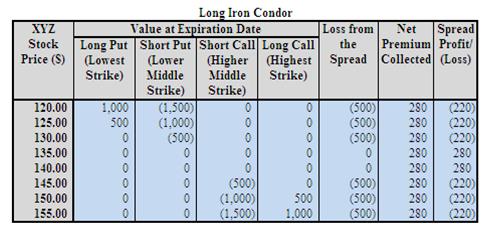

#Iron condor example professional

Trading stock options, long the territory of professional investors, has become much more popular among individuals. By clicking ‘Sign up’, you agree to receive marketing emails from InsiderĪs well as other partner offers and accept our

0 kommentar(er)

0 kommentar(er)